0

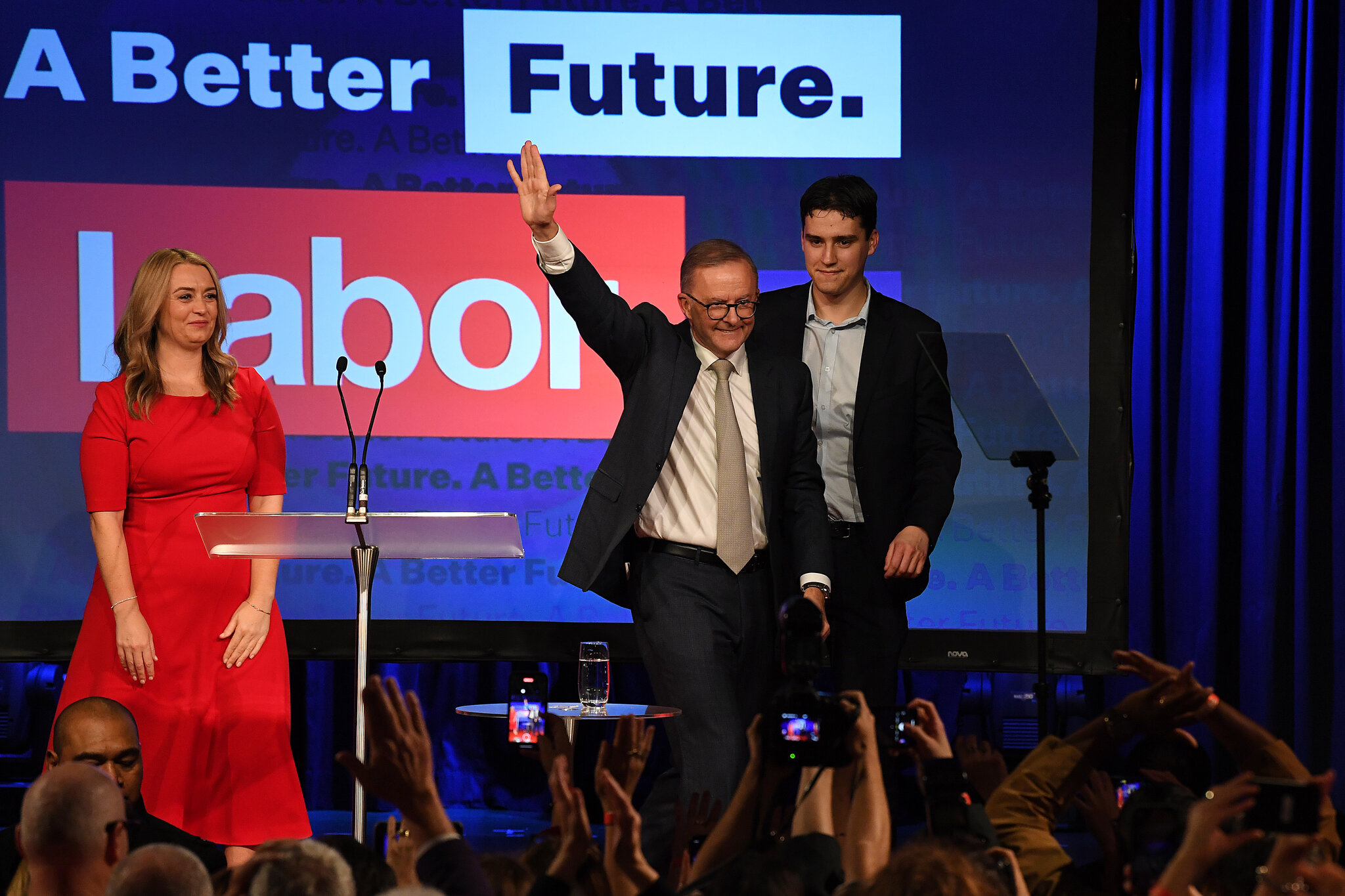

Australian equities retreated Monday despite a historic political milestone, as Prime Minister Anthony Albanese secured a rare second term — the first consecutive re-election of a sitting Australian leader in more than two decades. The market’s muted reaction underscores investor caution amid global economic uncertainties and light regional trading volumes due to multiple public holidays across Asia.

The S&P/ASX 200 index dropped 0.83%, pulling back from Friday’s high — its best close since late February — as traders digested the implications of political continuity and a shifting international landscape. While Albanese’s win signals voter support for stability, analysts noted that markets may be bracing for potential policy recalibrations or delays in reforms ahead.

Meanwhile, the Australian dollar edged 0.33% higher against the U.S. dollar, trading at 0.6462. Currency markets generally reflected a subdued but positive sentiment towards Albanese’s re-election and its implications for macroeconomic continuity.

Broader regional activity was subdued with markets in Japan, South Korea, Hong Kong, and mainland China closed for public holidays. However, in Taiwan, the Taiex index slipped 1.31% amid volatile trading, even as the New Taiwanese dollar strengthened sharply — appreciating 3.14% to 29.741 against the greenback, reaching its highest level in nearly three years.

China’s offshore yuan also saw modest gains, rising slightly to 7.206 per dollar, with earlier session movements marking its strongest level since November 2024.

In commodities, oil prices dropped sharply after the OPEC+ alliance announced plans to increase output for a second consecutive month. Brent crude futures fell 3.62% to $59.07 a barrel, while West Texas Intermediate crude declined nearly 4% to $56.00, as concerns over potential oversupply pressured prices lower.

U.S. equity futures pointed slightly downward in early Asian hours, suggesting a pause after a week of robust gains on Wall Street. On Friday, the S&P 500 advanced 1.47% to close at 5,686.67, notching its ninth straight day of gains — the longest winning streak since November 2004 — and fully rebounding from losses tied to renewed tariff threats earlier in April.

The Dow Jones Industrial Average surged 564 points to finish at 41,317.43, while the Nasdaq Composite rose 1.51% to 17,977.73, driven by tech optimism and easing rate expectations.

While Australia’s political scene has settled, financial markets are likely to remain sensitive to global cues — particularly upcoming central bank decisions, trade tensions, and energy dynamics — as investors weigh the resilience of the post-pandemic recovery.

Disclaimer: The information contained herein (1) is proprietary to BCR and/or its content providers; (2) may not be copied or distributed; (3) is not warranted to be accurate, complete or timely; and, (4) does not constitute advice or a recommendation by BCR or its content providers in respect of the investment in financial instruments. Neither BCR or its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Lebih Liputan

Pendedahan Risiko: Perdagangan Kontrak untuk Perbezaan dengan margin melibatkan tahap risiko yang tinggi, dan mungkin tidak sesuai untuk semua pelabur. Dengan berdagang Kontrak untuk Perbezaan, anda mungkin menanggung kerugian semua dana yang anda depositkan. BCR tidak membuat sebarang cadangan berkenaan kebaikan mana-mana produk kewangan yang dirujuk di laman web kami, e-mel, atau bahan berkaitan kami. Maklumat yang terkandung di laman web kami, e-mel, atau bahan berkaitan kami tidak mengambil kira objektif perdagangan, situasi kewangan, atau keperluan pelanggan prospektif. Sebelum memutuskan untuk berdagang Kontrak untuk Perbezaan yang ditawarkan oleh BCR, pastikan anda telah membaca Penyata Pendedahan Produk , Panduan Perkhidmatan Kewangan , Penentuan Pasaran Sasaran , dan telah mencari nasihat kewangan profesional yang bebas untuk memastikan anda memahami sepenuhnya risiko yang terlibat sebelum berdagang.

BCR adalah nama perniagaan berdaftar Bacera Co Pty Ltd, Nombor Syarikat Australia 130 877 137, Lesen Perkhidmatan Kewangan Australia 328794.

Maklumat di laman ini tidak diarahkan kepada penduduk mana-mana negara tertentu di luar Australia dan tidak bertujuan untuk diedarkan kepada atau digunakan oleh mana-mana individu di mana-mana negara atau bidang kuasa di mana pengedaran atau penggunaan sedemikian akan bertentangan dengan undang-undang atau peraturan tempatan.